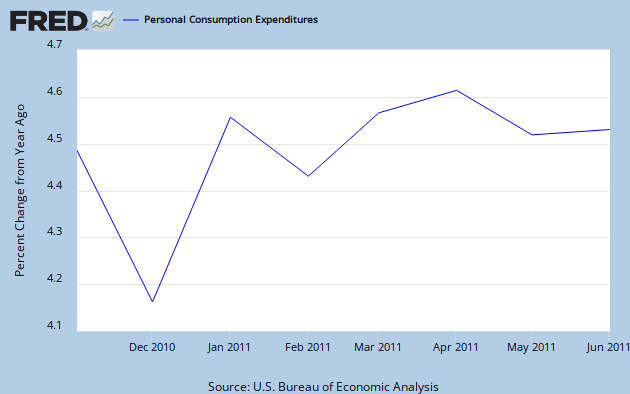

How about a reality check. Let's take a look at the percent change in PCE from the previous year, starting in November 2010.

See the "notable rise" in PCE inflation? Try squinting. Of course, Kocherlakota hedges a bit by claiming that the increase occurred during the first half of 2011, which conveniently ignores the subsequent decline (both of which were mainly driven by oil prices). The argument that PCE minus food and gas prices have also increased is equally hyperbolic -- unless a move from 1% to 1.3% inflation is worrisome.

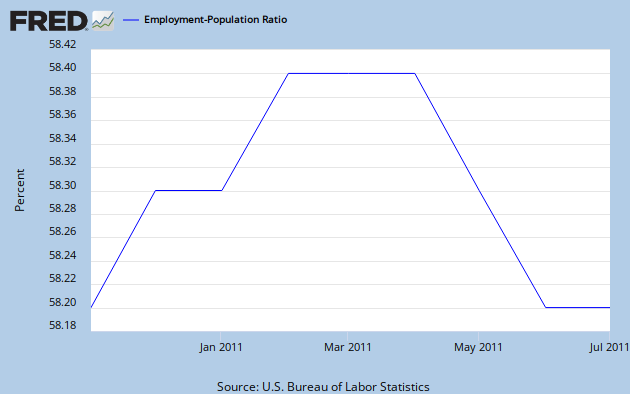

What about unemployment? Given that it has come down from 9.8% in November 2010 to 9.1% in July 2011, perhaps further action is unwarranted. Unfortunately, this statistic is misleading. The U3 measure of unemployment ignores discouraged workers; the civilian employment-population ratio gives us a more accurate assessment of the labor market.

See the fall in unemployment now? If the economy is not already back in recession, it is certainly stuck in a "growth recession", where not enough jobs are being created to keep up with population growth. The output gap is steadily widening.

Confronted with subdued inflation expectations and a deteriorating jobs market, the Fed dissenters insist that the reverse is true. This is Don Quixote economics: waging war on imaginary problems while real ones persist unabated. It reflects little more than irrational angst over unconventional monetary policy, coupled with a misplaced conviction that any uptick in inflation augurs the return of stagflation. Regrettably, empirical evidence will not convince the inflation hawks that it is not 1980, nor will the continuing jobs crisis move them to act. As long as inflation runs between 1-2%, they consider it mission accomplished.

Meanwhile, the economy is falling even further below its long-term trend.

No comments:

Post a Comment