Recall that the debate at the time centered on how much of the recovery act would be composed of spending programs versus tax cuts. Liberals argued that the ARRA should have been weighted more towards government spending, such as infrastructure, because it was more stimulative than tax cuts that would likely be saved instead of spent. However, a combination of practical (a dearth of shovel-ready projects) and political (wooing enough moderate Republicans to break the filibuster) concerns ultimately led to roughly 37% of the stimulus coming in tax cuts -- but there was a twist.

Tapping the insights of behavioral economics, the Obama administration tried to structure the tax rebates such that households would be more likely to spend them. Here is James Surowiecki explicating this strategy:

You might think that handing people a big chunk of change is a perfect way to get them to spend it. But it isn’t, because people don’t treat all windfalls as found money. Instead, in the words of the behavioral economist Richard Thaler, people put different windfalls in different “mental accounts,” which in turn influences what they do with the money. [....]

The key factor in these kinds of distinctions, Thaler’s work suggests, is whether people think of a windfall as wealth or as income. If they think of it as wealth, they’re more likely to save it, and if they think of it as income they’re more likely to spend it. [....]

So what does this mean for making a rebate work? If you want people to spend the money, you don’t want to give them one big check, because that makes it more likely that they’ll think of it as an increase in their wealth and save it. Instead, you want to give them small amounts over time. And you want the rebate to show up as an increase in people’s take-home pay, because an increase in steady income is more likely to translate into an increase in spending. What can accomplish both of these goals? Reducing people’s withholding payments.Unfortunately, this may have been too clever by half. Politically, designing a tax cut so that households will not notice they are receiving it was a predictable disaster. Indeed, shortly before the 2010 midterm elections, polls showed that only one in ten respondents knew that Obama had actually reduced taxes for 95% of Americans. But there is an argument that this was perhaps a misguided economic policy as well.

One interpretation of our economic malaise is that we are still suffering from a debt overhang among households. The nominal shock of the housing bubble collapsing left many households underwater on their mortgages, and consequently drove them to begin paying down debt. Even with short-term interest rates parked up against the zero bound, there is a dearth of borrowers among households -- which also depresses business investment, since there are not as many profitable opportunities in an environment where consumers are retrenching. This economic weakness will persist until the private sector is finished deleveraging. The best the government can do is to simply avert complete collapse by borrowing the excess of desired savings over investment. This is Richard Koo's theory of the "balance sheet recession" (there is a counter-argument that if the Fed embraced more unconventional policies, it could stabilize nominal spending and end the slump, but that is for another post).

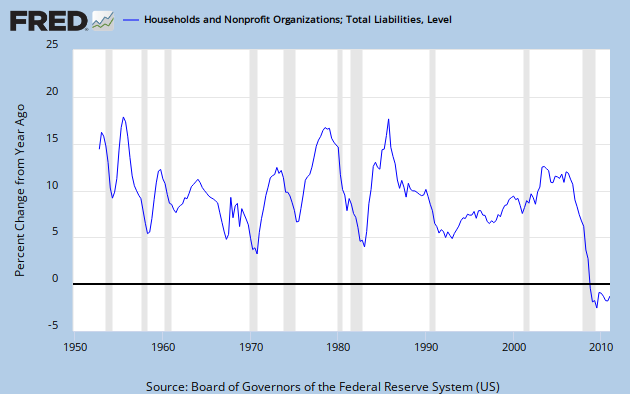

The data on household debt certainly supports the view that this time, the recession really is different. Indeed, for the first time in the post-war period, households have actually begun reducing the amount of debt on their balance sheets.

That leaves tax rebates. At the risk of sounding tautological, giving households money to pay down debts obviously speeds up the process of paying down those debts. The sums involved from the ARRA were not very large -- $400 for single-earner households; $800 for couples -- but the notion that it would have been a "waste" if households did not spend those checks misses the point of the balance sheet recession. Sending out lump sum tax rebates might have been the more efficient policy over the longer-term, since that presumably would have led to households putting themselves on firmer financial footing faster than they otherwise did.

To be sure, the government needed to spend money to provide a stream of income to the private sector so that it could save. But the Obama administration might have been better served thinking of the tax cuts as a means to hasten the rebuilding of household balance sheets, and of public spending as a means to set a floor under the economy, rather than conceiving of both as the latter.

The great irony is that an unconventional recession perhaps called for a conventional response on taxes.

I don't agree. The balance sheet recession view is likely correct, but it does not necessarily follow from this that the correct response is to allow desired savings to rise, or to encourage it. Actual savings will be highest when incomes are brought back to trend. If higher desired savings leads to lower incomes through the multiplier process than that may mean lower actual savings, at least compared to the counterfactual of effective demand stimulus.

ReplyDeleteIn the old Keynesian analysis, the two effects would precisely cancel: if the money from the tax reduction is saved it lowers the debt burden by the amount of the tax. If the tax reduction is spent, there is the usual Keynesian multiplier on incomes, but only 1-MPC of that income is subsequently saved. So that the overall effect is the same amount of deleveraging whether the tax money is spent or saved - except that this analysis applies only to the short run. In the long run, incomes/investment are brought up towards trend growth so that increasing incomes is the preferred method of encouraging deleveraging.

Thinking that saving the extra money would aid in the deleveraging process is another example of the fallacy of composition in effect. It is certainly true for the household, but not for the economy as a whole.

I agree with bseconomist. The focus should be on incomes. Just getting people out of the red will not encourage borrowing when incomes are uncertain. In this, people are just like businesses. When their incomes are rising and their income sources secure, they are willing to borrow. When incomes are stagnant or falling and likely to fall more, they will not borrow. Fix incomes, and everything else will flow from that.

ReplyDeleteAlso, don't worry about the banking sector. Worry about savers and their savings. If the government indemnifies savers up to some level we could simply liquidate the banking sector. That would fix the overhang problem, but leave plenty of money for lending once the income problem is dealt with.